Dear readers, friends,

We’re living in very interesting times. The unipolar world order, built under the lead of the U.S. since the end of the Soviet Union, disintegrates; fault lines among new power blocs are developing. At the same time, Donald Trump isn’t someone who takes anything for granted – he’s ready to take a fresh look at everything, and it he deems it appropriate, put it on its head.

Gold is an asset which has always been an anchor for safety. But this time, Donald Trump might put gold at the center of revolutionary economic policies. Lots of research again - I hope this is interesting for you! Please drop me a ‘like’, subscribe if you haven’t done so, and let me know your thoughts!

(California, 1848)

London is widely considered the center of the world’s physical gold market. Under the oversight of the London Bullion Market Association (LBMA), in recent years about 30 million ounces were traded daily in spot markets for immediate delivery, representing a value of about $100 billion. London has been a hub for trading since the 17th century, and its banks have developed a priced tradition for safekeeping and robust operations.

The Bank of England, the UK’s central bank, holds its own gold reserves in vaults beneath the City of London, recognized to be among the most secure in the world. But the BoE also acts as a custodian for gold of other countries, including many European countries and even Germany, but also India, South Africa, and Russia. This custodial role is due to the UK’s past colonial empire, but also to World War II when other countries moved their gold reserves to London to get them out of the Continent.

But over the last few weeks, cracks have formed in London’s smooth operations. Usually, buyers can pick up gold a few days after transactions. The waiting time has now increased to eight weeks. Financing rates for borrowing gold, usually measured in basis points, have increased more than tenfold. It is well known that global central banks have been buying large amounts of gold in the last two years. But the rise in demand for gold from the London vaults since December 2024, and its escalation since early February, have surprised seasoned traders. Something’s going on.

The U.S. Sovereign Wealth Fund

Donald Trump has made signing executive orders a morning routine attended by representatives of the major news outlets. On February 3, Trump stunned them with an executive order to set up a sovereign wealth fund. SWFs are investment funds operated by states – typically countries which run government budget surpluses which they use to build long-term wealth, like Norway, Dubai, or Abu Dhabi (all of which generate large income from the sale of oil and gas), but also well-managed countries such as Singapore. They have over time built funds worth hundreds of billions of dollars, or even more than a trillion (Norway). But the U.S. isn’t exactly known for running budget surpluses.

Treasury Secretary Scott Bessent said in the meeting, “We’re going to monetize the asset side of the U.S. balance sheet for the American people.” He also said the fund would be set up in 12 months.

Where is the money supposed to come from?

This could turn into one of the most incredible stories in modern finance, a story that sounds utterly crazy and unthinkable only a few years ago. It all starts, once again, with the Federal Reserve.

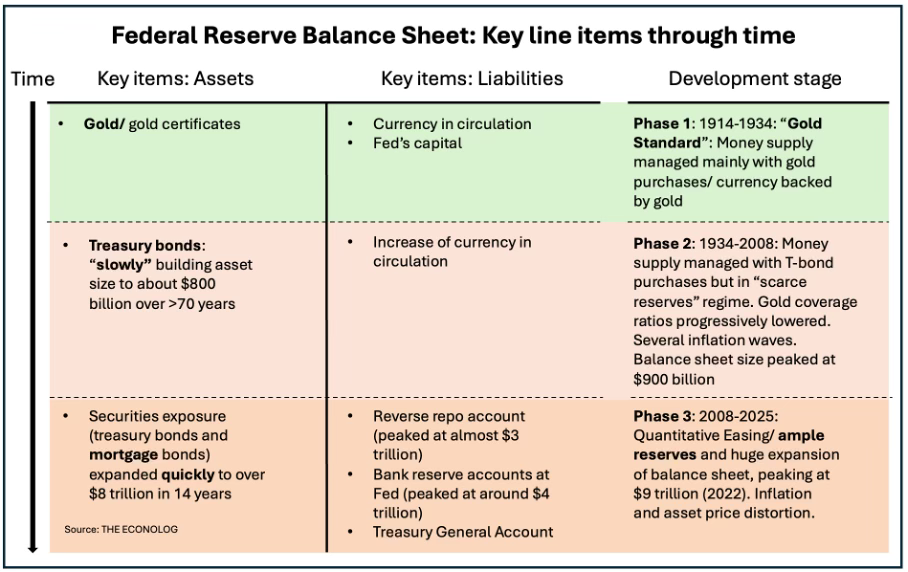

At the very bottom of it, a central bank has exactly one function: it provides money to the economy. To create that money, a central banks buys assets. When the Fed was founded in 1913, the key reserve asset was gold, same as for the German Bundesbank, the Bank of England, and others, in a time known as the ‘Gold Standard’ when currency in circulation was actually backed by and convertible into gold. In later years, central banks switched to financial assets like government bonds and foreign currencies (At the bottom of this posting, I added a short chart for the development stages of the Federal Reserve).

But here’s the snatch. In 1934, U.S. President Franklin Roosevelt signed the Gold Reserve Act which transferred ownership of gold in the Fed’s vaults from the Fed to the U.S. Treasury. In return, the Fed received ‘gold certificates’ from the Treasury at an exchange rate of $35 for an ounce of gold1.

(printed gold certificate; today replaced by electronic accounting entries.)

That’s a little understood, but key difference between the Fed and other global central banks like the Bundesbank or the BoE. In the U.S., the Treasury owns the country’s gold, not the central bank. Therefore, the Fed doesn’t benefit from market value gains of gold. The best it can do is sell back its certificates to the Treasury at an exchange rate of $42 2/9 per ounce of gold, not really the best deal today.

The Treasury is sitting on about 280 million ounces of gold, roughly half of which stored in the New York branch of the Federal Reserve, the other half in Fort Knox, with a combined book value of just above $11 billion. What to do with it? Gold is the largest unused asset of the U.S. government. What Treasury Secretary Bessent might have in mind: The Treasury could repeat its 1934 exercise, and issue new gold certificates to the Federal Reserve but marked more closely to today’s spot prices of almost $3,000. In return the Fed would pay up to $800 billion into the Treasury’s account at the Federal Reserve (Treasury General Account, TGA). Take note that neither the Fed nor the Treasury would have to sell a single ounce of gold in that transaction, which is pretty remarkable. Donald Trump can then use that money to finance his sovereign wealth fund.

The whole process looks like financial wizardry on the highest level, but in fact it’s actually not very different from Quantitative Easing as carried out since 2008.

Three noteworthy observations:

Any money created in that process is fully backed by gold. Should the Fed want to sell certificates back to the Treasury, the Treasury can raise money by selling gold in the open market.

In an interesting coincidence, at current market prices gold reserves would be valued at $800 billion, which is essentially the same as the Fed’s total balance sheet investment assets in 2008, just before the GFC2.

Depending on its size, the mark-up will cancel out months or even more than a year of balance sheet normalization (Quantitative tightening). The very tricky part will be figuring out how the money will flow from the TGA into the economy without becoming inflationary. There’s a lot of opportunity for mistakes. Forget about cuts in policy interest rates in such a scenario. If anything, rates will rise.

A new risk paradigm

One way or the other, the global financial system is changing with gold playing a much larger role in it. Central banks especially in the BRICS countries have started buying large amounts of bullion, and they have become the biggest buyer group.

But all major central banks are pulling in their global gold reserves. The German Bundesbank had its reserves distributed among the New York Federal Reserve, the Bank of England, France, for strategic reasons: Parking gold near the markets with the greatest liquidity for physical trades, and diversification for security reasons. But Germany has pulled back most of the New York and France deposits in recent years. Germany was a frontrunner, but many others followed: the Netherlands, France, Austria, India, Poland and other European countries shifted deposits to their home countries. A survey3 showed that in just three years, from 2020 to 2023, the share of central banks which kept the majority of their holdings domestically increased from 50% to 68%. The security paradigm in changing: up until a few years ago, gold was moved abroad for risk management. Today, gold is repatriated for risk management.

Electronic payment platforms like SWIFT have become the backbone of global trade and capital flows, creating huge dependencies on those platforms. Kicking a country out of SWIFT is really painful. It limits those countries’ abilities to conduct international trade, leads to isolation, and hinders their economic development. In the last few years, several countries have been excluded at least partially: Russia, Iran, Cuba, or Sudan. Having physical gold at hand at a time of rising geopolitical risks protects countries from insolvency.

In a new age of industrial policy, restrictions on trade are rising rapidly. The U.S. has imposed restrictions on sales of advanced microchips to China, a key resource for AI development, part of a strategy to contain China militarily. It’s not unthinkable that restrictions on other resources will follow, including gold (even if highly unlikely).

A few weeks ago, U.S. President Donald Trump warned other countries against any efforts to build reserve currencies competing with the dollar. The warning was directed mainly against the BRICS countries. If they really wanted to create a BRICS currency, or a lead currency among the BRICS countries like the Chinese yuan, they need a certain level of gold backing for liquidity and credibility. Donald Trump is moving quickly with his executive orders and policies, and he might make it much more difficult to repatriate gold soon.

There is, however, another implication on a more profound level. The global trade and financial system, built in a unipolar world since the end of the Soviet Union, is unraveling (a process which I called ‘the Great Divergence’ in a posting last year). Repatriation of gold and massive new purchases signal that the disintegration is accelerating. The demarcation between the U.S.-led western hegemony and new powers around India and China deepens. I am pretty sure that Donald Trump will use trade policy to outline boundaries between the U.S. and new power blocs even more. In his speech at the Munich Security Conference on February 14, U.S. Vice President JD Vance said Europe will have to learn to stand on its own; the U.S. will direct its resources at new threats.

The idea that Donald Trump launches a gold-funded sovereign investment fund (and, on the side, a return to a gold-backed dollar) sounds crazy. But the disruptive force of Trump is larger than anything the world has seen before; just this week he antagonized NATO with a peace initiative for Ukraine which wiped away NATO’s (and the EU’s) stratagem for negotiations. There will be much more to come.

Gold market participants have taken note of the disruptions of physical deliveries as global central banks are positioning themselves. But news coverage, even in the financial press, has been slow to pick up on the signals with very few exceptions. Retail investors are still underinvested in gold with allocations way below pandemic levels. Even though gold prices have climbed more than 40% since the beginning of 2024, it may be worth finally taking a look.

(American Eagle 1/4-oz)

And by the way, compared to stocks and bonds, physical gold is a tangible asset that’s actually quite nice to hold in your hand.

Let me know what you think!

All the best,

John

Reminder – I’ll switch to paid subscriptions soon!

Here's an abridged overview the key balance sheet items of the Federal Reserve:

If the Treasury sells new gold certificates to the Federal Reserve, the asset side on the balance sheet will increase by the same amount as the liability side (the Treasury receives money for certificates in the Treasury General Account) – a balance sheet extension just like quantitative easing. The inflationary push comes when the Treasury spends its new money (TGA goes down), and both bank reserves and currency in circulation will increase.

In 1974, the price of the certificates was adjusted to $42 2/9. The Gold Act also applied to citizens. From 1933, it was illegal for citizens to own gold, a law which was abolished only in 1974 under President Gerald Ford.

The U.S. economy today is twice as large than in 2008. In a thought experiment, if the gold price doubled to $6,000 the U.S. could switch to a fully gold-backed currency.

Invesco 2023 survey

Amazing article. Finally light bulb moment for monetizing our gold bullion and what that could mean as an inflationary impulse

Great read cheers, I’m heavily invested in gold & silver miners especially juniors for more leverage