The D.O.G.E of Washington

Four charts about U.S. public finances and the new Efficiency Department

First things first: Welcome again to my new subscribers – around 500 this week! I am humbled by your response and interest in my work. Many thanks for your support! I hope you’ll find an engaging and inspiring community over here.

After last week’s discussion of the sobering outlook for Germany under destructive policies, this week I’m turning to an economic policy which actually makes a lot of sense. The President-elect of the U.S. announced his Efficiency Department. This was an entirely unexpected strategic coup but representative of Trump’s unpredictability. Very few data points are available so far on this initiative, but I’ve run the numbers for an initial assessment what it means for the economy – once again, I’m pretty sure you won’t find this analysis anywhere else. Hope this is helpful! If so, please drop me a ‘like’ and spread the word!

(Paradiso by Tintoretto. Painting in the palace of the Doge of Venice/ Palazzo Ducale)

The U.S. federal government deficit was waiting as the biggest headache for any incoming government. At six percent during a strong economic expansion, and on track to rise even higher, government spending wasn’t sustainable. Bond yields started rising in anticipation of more government debt and inflation in a Trump administration, in the belief he was going to cut taxes and raise import tariffs.

Quick status assessment

There’s a surprising variety of opinions out there about debt sustainability. What makes debt sustainable or not isn’t just a function of its total size, but an economy’s ability to service it. As long as interest is paid in time, lenders aren’t worried. On the face of it, current government debt isn’t that bad, because interest as a % of GDP is pretty much in line with historical experience.

(Interest expense: still looking good?)

Treasury Secretary Janet Yellen is even less worried, thinking about debt in an unorthodox way. She looks at debt service (% of GDP) minus the inflation rate1. As long as “real” debt service is below 1.5%, all is fine, she suggested in a Bloomberg interview on May 13, 2023.

(From bad: debt held by public escalating ….)

It sounds a lot like what we’ve heard from investment bankers before in defense of endless expansions of debt cycles, and usually it didn’t end well: from the high-yield excess for leveraged buy-outs in the 1980s, leveraged speculation (LTCM) in the 1990s, GFC in the 2000s, and so on.

Another crisis is already on the horizon, as costs for debt service will rise. Based on data of the Congressional Budget Office (CBO), I ran a quick scenario analysis how deficits and debt service change if interest rates converge, over a transition period of 10 years, towards an average of 4.5%.

(… to worse: because of higher bond yields, “real” debt service will soon exceed Yellen’s limit of 1.5%, and even Summers’s limit of 2%)

Circuit-breaking

Influential policymakers in the past have enabled an accelerating debt and deficit cycle. Ben Bernanke, chairman of the Federal Reserve, thought up the new central banking paradigm of ample liquidity. Expanding balance sheets of central banks made it much easier for the Treasury to issue record volumes of bonds after the Global Financial Crisis (GFC). Jerome Powell bought bonds at an even faster clip during the pandemic. Treasury secretaries Janet Yellen and Larry Summers created the academic backbone for debt expansion. The bureaucrats, all playing along, rolled the debt avalanche forward.

The D.O.G.E. plan, finally, has the potential to become a circuit-breaker. A disruptive event requires a disruptor - Donald Trump. He announced to set up the Department of Government Efficiency, with the goal, in Trump’s words, to “dismantle Government Bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure Federal Agencies”. The ambition is huge.

“It will become, potentially, ‘The Manhattan Project’ of our time.” (Donald Trump)

The framework how DOGE will operate is still being hammered out. Probably it will act as an advisor, outside the government, to the White House and the Office of Management and Budgets. The department will be run by Elon Musk and Vivek Ramaswamy. DOGE is set to conclude on July 4, 2026, the 250th anniversary of the Declaration of Independence.

Ramaswamy posted on X, “We shouldn’t let the government spend money on programs that have expired. Yet that’s exactly what happens today: half a *trillion* dollars of taxpayer funds ($516 B+) goes each year to programs which Congress has allowed to expire. There are 1,200+ programs that are no longer authorized but still receive appropriations. This is totally nuts. We can & should save hundreds of billions each year by defunding government programs that Congress no longer authorizes”.

Elon Musk, known to run very lean, result-driven companies, said he expected to find up to $2 trillion in savings, almost 30% of total government outlays in 2025. Keep in mind that Musk cut expenses at X by 80% without an interruption in service.

Where are savings supposed to come from?

The “easy wins”: Weird outlier projects

On top of the expired programs which Vivek Ramaswamy mentioned, social media users happily supplied input for programs which should be shut down. Here are some popular favorites:

* $1.5 million studying the effects of yoga on goats* $1 million to study the effects of music on dairy cows

* $1.7 billion to maintain empty buildings

* $500k to study HIV in ‘transgender’ monkeys

Probably the broader public will not support those programs any longer.Structured identification

DOGE is setting up a working group to go through all spending programs, check them for efficiency and usefulness, and axe everything that’s not. In principle this is a standard approach of consulting firms, but with a much larger ambition.

It’s going to be very tough for many government employees, unfortunately. In an interview, Musk noted the number of government agencies had grown already to 428. Why not cut them to 99? Donald Trump intends to shut down the Department of Education, to hand responsibilities back to state level.(Investment bank J.P. Morgan just announced to limit working hours for junior bankers to 80 hours per week. If that’s too lame for you, here’s an alternative!)

Prevention of fraud

The U.S. Government Accountability Office (GAO) estimates the government lost between $233 billion and $521 billion annually in the years 2018-2022 to fraud2 (consider that the risk environment for fraud in 2018-19 was very different than in the pandemic years, which offered all kinds of support programs).

Therefore, risk mitigation/ fraud prevention is another huge lever to reduce government spending.

What can DOGE achieve?

Political analysts have pointed out that large, draconian measures will have to pass significant hurdles. If DOGE will act as an advisor, as expected, it won’t have formal decision powers. And even the president will have to circulate DOGE recommendations for large cuts through Congress. Shutting down expired programs is one thing. But closing down entire agencies and departments, laying off legions of people, is entirely different on many levels.

However, spending cuts are a key policy of Donald Trump, and he has won both chambers. Trump will need large spending cuts to support another key initiative, tax cuts. So one thing is clear, the stakes for DOGE couldn’t be higher.

This is a very unique situation - the biggest and most complex bureaucracy facing the largest and most ambitious attack on it.

Let’s run the numbers.

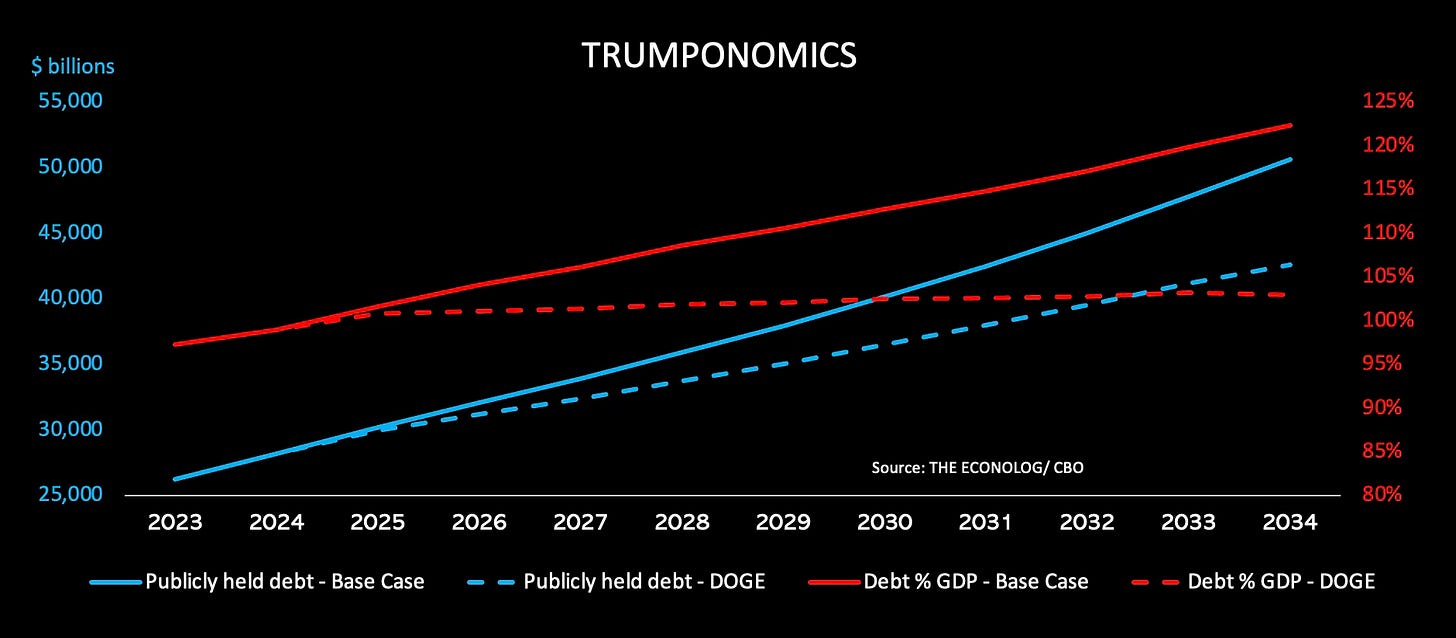

I thought back to my investment banking days, brushed off my excel skills, and crunched some data over the last 2 nights to find out: what does DOGE mean for government deficits and government debt? Will it break the vicious debt escalation cycle?

I kicked off with the CBO’s budget projections over the next ten years. They are the government’s income statements (the starting point for valuations in banking).

Main parameters for my “Trumponomics” base scenario:

DOGE cuts the government expense base by $1 trillion (2024 spending: $7 trillion) or 50% of Musk’s ambition. $500 billion of expired programs which continue to be paid have already identified.

The lower base will be carried forward. Incremental increases just as forecast by the CBO.A cut in income taxes of 25% for everybody (permanent)

An import tariff flat 10% on all imports (raising $300 billion annually)

Obviously, there are second and third order effects. Lower deficits lead to smaller government debt and declining interest expenses, which in turn lead to lower spending and so on.

Under those parameters, the debt-to-GDP ratio will stabilize at its current level of just above 100% for the foreseeable future. DOGE has the potential to improve public finances dramatically, but it’s also a huge incentive to cut taxes too far.

(Summary projection of Trumponomics. Solid lines are CBO projections, but under capital market assumptions of a convergence of debt costs to 4.5% (CBO estimate is 3.4%). Dashed lines are projections of the impact of the three core economic policies of Trump: Tariffs, tax cuts, and expense savings. The debt/ GDP ratio stabilizes at just above 100%).

The model is set up to tweak the main input values easily. What do you think about Trump’s main policies? Can Musk and Ramaswamy deliver $1 trillion of savings? More? Less?

I added a survey below. If there’s enough interest, I’ll follow up with an analysis based on feedback consensus. The survey is open for one week. Or DM me if you have a strong opinion on either of the parameters.

Hope this was interesting! Let me know what you think,

All the best,

John

This line of thinking was originally introduced in a paper co-written by Harvard economist Jason Furman and former Treasury secretary Larry Summers, who argued that governments should expand government spending in an era of low growth and very low interest rates. However, their paper “A Reconsideration of Fiscal Policy in the Era of Low Interest Rates” was written in 2020, a period of record-lows in inflation and interest rates which was expected to persist.

Great write up here from Econolog on DOGE.

The current rate of debt accumulation in the United States is flatly unsustainable.

The US has become locked in a death spiral of debt for some time:

When in power, the democratic party expands spending but fails to raise taxes.

When the GOP is in power, they raise taxes and fail to cut spending.

Will DOGE break the cycle? I wouldn’t hold my breath, but never bet against Elon Musk.

A late comment and request - this is excellent and will you set up a DOGE Tracker???