THE CHINA SYNDROME

The Country´s Blind Spot May Have Averted the Most Serious Military Conflict of Our Time

Here´s another key ingredient for the geopolitical and strategy outlook. China was growing into a major component of investment portfolios, but the outlook for the country has changed dramatically in recent months. In fact, over the last few days I decided to re-write the overall conclusions.

China attended the 2024 World Economic Forum in Davos, Switzerland, with a large delegation. It was headed by premier Li Qiang, the most senior Chinese official to attend the WEF since President Xi Jinping in 2017. In his keynote speech, Li Qiang struck an unusual conciliatory tone. China, he said, was open for business. Qiang advertised investment opportunities in China, talked about the progress the country had made, about the need to foster competition and trade to tackle global challenges.

But relations between China and Western countries are at a low point. For the first time in 12 years, foreign investment into China fell in 2023. Chinese exports declined. In January 2024, Chinese authorities arrested the head of an overseas consulting firm on claims he was a spy for British service MI6.

The Chinese Way

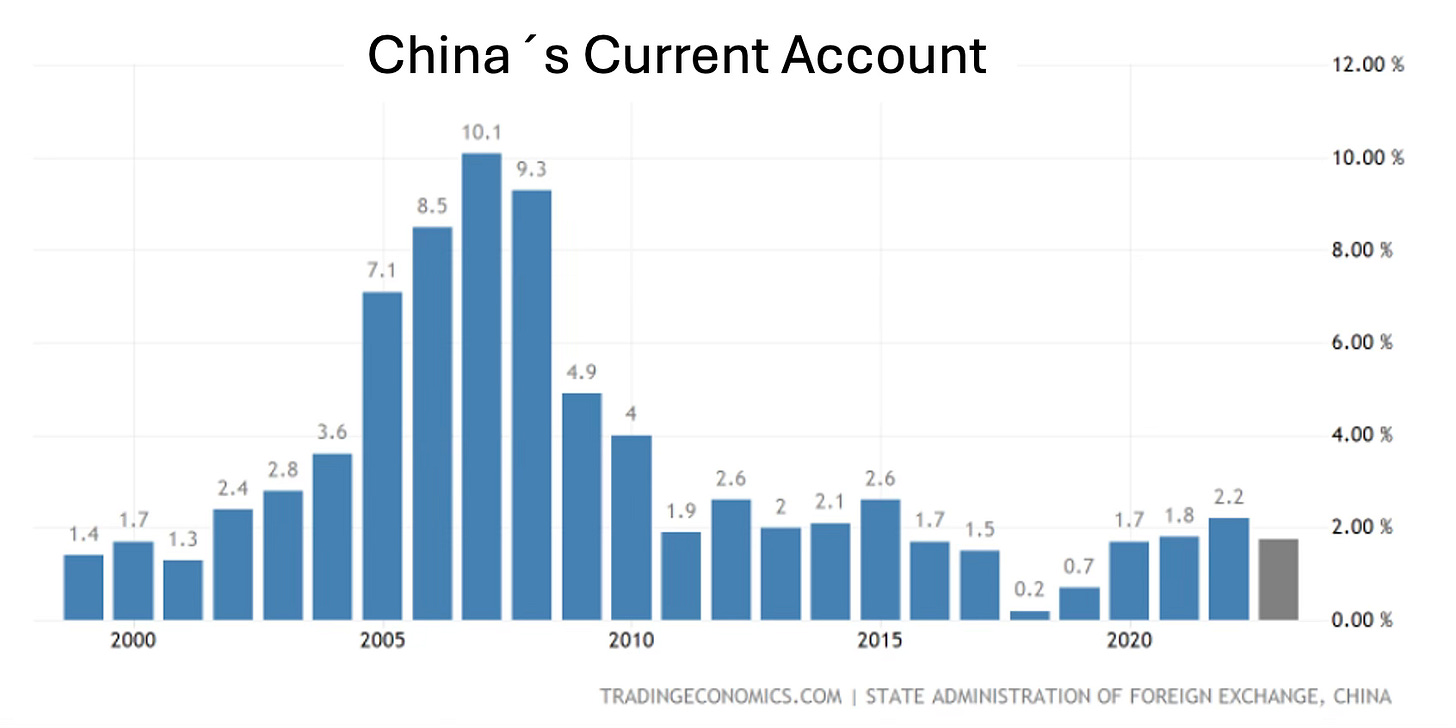

China hasn´t followed the standard economic playbook in its development. Typical emerging market countries invest heavily in their local economy when they catch up to developed economies. Investments often exceed savings, so those countries import capital and run a current account deficit.

China was different. Because of the one-child policy which the communist party had imposed formally in 19801, citizens had to build savings for their retirement as they could not count on support of children. Backed by very high savings rates, the country ran a current account surplus during the rapid development in recent decades. China exported capital when it invested heavily in other emerging countries.

The Chinese investment strategy was two-pronged.

The Belt and Road Initiative, a global infrastructure development strategy launched in 2013. The initiative is a cornerstone of China´s foreign policy to build greater influence and status globally, as China´s economic power rose. More than 150 countries have signed up to participate in the program, representing 75% of the world´s population and more than 50% of world GDP. Under the BRI, China built power stations, motorways, railroad grids, and steel plants, and other capital-intensive facilities.

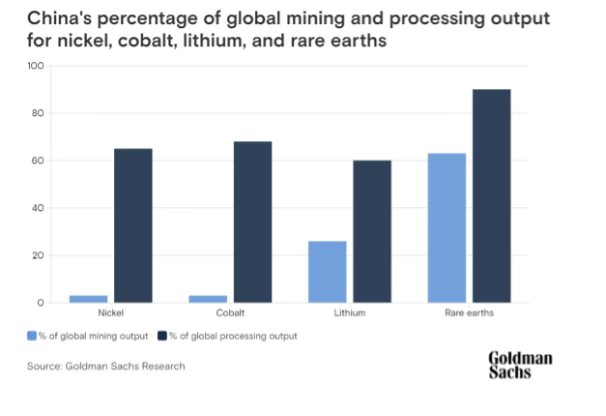

Access to natural resources. The Chinese development strategy is long-term. And in Chinese thinking, long-term means decades, or even centuries. China realized early on that the world was going to transition away from combustion engines and thermal energy to EVs and electrical power. The country has quietly acquired resource deposits of minerals and what is called “rare earths”, which are crucial for the development and production of batteries. After years of investing, China has developed a stranglehold over processing output of critical resources.

As a key component to catch up in technological and process know-how, China launched its “Thousand Talents” program in 2007. Chinese leadership had realized that many of the country´s brightest students went abroad for better training, career opportunities, and compensation. The original inspiration for the Thousand Talents program (TTP) was to bring back talented Chinese engineers, entrepreneurs, and managers to China. That´s a fair proposition, and that´s how progress generally works – know-how expands, productivity rises, countries progress. Researchers at western universities, especially in the U.S., happily took Chinese money in exchange for setting up research programs or sharing results.

But TTP quickly morphed into a very different kind of know-how extraction. It turned out that at places like Texas A&M University, over 100 teachers were involved in the operation, and 95% of them never disclosed it to the university. The TTP is run directly by the Chinese Communist Party (CCP). By 2017, the CCP reportedly had recruited 7,000 scientists, including 70 Nobel laureates. The alarm finally went off in western countries when it turned out that China had developed hypersonic missiles based on designs of NASA scientists.

The systematic transfer of know-how was a key component for China´s incredible growth over the last 20 years.

In the chart below, I indexed Chinese and U.S. GDP at 100 in the year 2000. The US has grown by a factor just below 3; China by a factor of 15 since 2000.

At the end of the 2010s, China had become the second-largest economy in the world which was going from strength to strength. It had the world´s largest armed forces and was building the largest navy. Time had come to focus on the next development step and to consolidate its new global power: reunite Taiwan into China.

Too much of a good thing

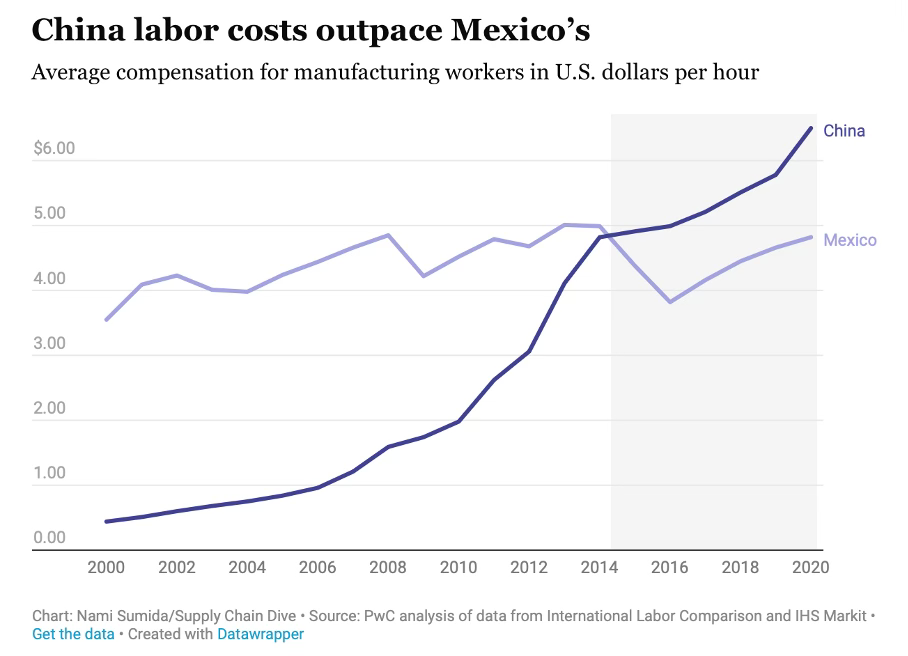

The pandemic of 2020-2022 revealed a big weakness of China. The country had essentially become an extended workbench of much of the rest of the world which used China´s large reservoir of comparatively cheap labor. Global consumers substituted local consumption.

But the pandemic drove home the hard message that global supply chains made companies much more vulnerable to unpredictable external impacts. International companies started to reassess their supply chain strategies more broadly, and soon three risks stood out.

Wages had risen quite substantially in China compared to other emerging countries. Wage growth during rapid economic development by itself is nothing unusual, but rather a desired by-product. However the fast wage growth in China is weakening the economic case.

Outsized dependency. Whole countries realized they had outsourced large parts of their manufacturing to China, from trivial items like bicycle spare parts to critical items like medical products. Hospitals in western countries couldn´t get their hands on medications when stocks ran low, as production was concentrated in China while shipping routes were blocked, and harbors were congested. During the early stages of the pandemic, China declined to supply masks, to maintain high stocks domestically.

Geopolitical risks. China was ramping up its preparedness for a move on Taiwan. Any military operation was going to trigger a global wave of sanctions against China. European countries found out the hard way what it means to be cut off from critical resources from Russia and Ukraine (which was a significant industrial manufacturing hub for Europe), but the exposure of many countries to China is even larger.

In recognition of this dependency, international companies have launched a transition to reverse their exposure to China, and to near-shore or relocate production. Foreign direct investment into China in 2023 fell for the first time in 12 years. In a 2022 poll of the European Chamber of Commerce in China, one quarter of its members said they were considering moving their operations out of China. The Director General of the Confederation of British Industry said every company he had spoken to was reconsidering its focus on China for its supply chains2.

A shift of an economic paradigm with huge consequences

As China´s economic model unravels, the slowdown exposes more cracks in the system.

Chinese investors and consumers are unnerved by stock markets which underperformed strongly. In one of the best years for equity investors in other regions, the Shanghai Composite index was down 3.7%, and Hong Kong shares declined by almost 14%. At the end of 2023, the government approved a new round of online games to prop up markets.

But the slump continued. In January 2024, at the time of this writing, Hong Kong stocks were down an additional 10%, and Shanghai stocks 5%. Japan´s stock market capitalization overtook China, and the valuation discount of Chinese stocks compared to other emerging markets like India reached record levels.

On January 22, Bloomberg News reported that the Chinese authorities were going to mobilize 2 trillion yuan, about $280 billion, from state-owned companies for a stock market stabilization fund.

The real estate sector, among the largest components of GDP, is failing after years of overinvestment which left China with ghost villages and empty neighborhoods in large cities.

Essentially all of the large development companies are now in bankruptcy. Home sales are anemic.

The Belt and Road initiative has slowed down dramatically. In 2016, project funding peaked at $28.5 billion. In 2022, it was below $1 billion, as Chinese authorities found out that many debtors could not pay back loans. According to researchers from the World Bank, the Harvard Kennedy School, the Kiel Institute for the World Economy, and AidData, China has become an emergency lender and spent $240 billion bailing out BRI member countries between 2008 and 2021.

China urgently needed a new vision to unite the struggling country behind the Chinese Communist Party, a new target on which to collect strength. And for politicians, what is the ideal scapegoat so to draw attention away from economic struggle? An external adversary. Taiwan.

But China ran into an internal problem that´s even worse

In August 2023, China´s president Xi Jinping launched a sweeping crackdown across the most senior government and military officials to remove them from office, and potentially worse.

In July, Foreign minister Qin Gang, one of the closest allies of the president, disappeared. At the end of July, the government announced he was dismissed.

In October, Jinping formally fired defense minister Gen. Li Shangfu. Shangfu had already gone missing for two months.

At the end of the year, Xi Jinping sacked nine high-ranking generals. Five of them were connected to China´s Rocket Forces, the strategic backbone of China´s military.

The brutal purge was a first indication that something had gone badly wrong.

When Xi Jinping took office as China´s president in 2012, one of his key ambitions was to modernize the military, and in particular to develop China´s rocket force, the 4th branch of the People´s Liberation Army. Jinping poured billions after billions of renminbi into the military to build rockets and launch bases spread out over the country in the years since.

But he failed to understand the temptations and incentives he created when he sent that kind of money to low-paid bureaucrats, who have overbearing responsibilities, work in remote areas, in a society with repressive communication structures and very little transparency.

The U.S. experienced it in Afghanistan, and Xi Jinping now in his own country. People start syphoning off money which was supposed to go into weapons and supplies purchases. Reports of western intelligence services circulated in the last days which claim that in site inspections, rockets were found which had been fueled with water instead of rocket fuel. Launch silo doors didn´t open due to bad parts and lack of maintenance, making it impossible to fire rockets. Military personnel had diverted fuel for private use.

Xi Jinping now faces a massive problem. He can´t just send some more fuel. What about launch systems, and flight control systems? Are they operational? Have electronic components been removed just like fuel, or become dysfunctional under bad maintenance? Even if not – the military just doesn´t know. The PLA will have to run a full, bottom-up audit.

The news leaves us with two scenarios.

Scenario 1: the reports are wrong or overstate the problem. In this scenario, there´s nothing to stop China´s global ambitions. Just two weeks ago and in advance of Taiwan elections, president Xi Jinping stated that “the reunification of the motherland is a historical inevitability”.

The economic implications are much more severe than Russia´s war on Ukraine, as China is the world´s second-largest economy. An attack on Taiwan will be the key trigger event for a massive correction in stock markets, and a wave of money flowing into government bonds, mainly USTs and German bunds. Regarding timing, I think the probability is higher before the U.S. elections, with former president Donald Trump more and more looking like a serious contender.

Scenario 2: the reports flag an authentic problem. That scenario is a catastrophic set-back for the rocket forces, and for China´s military ambitions, as it will take many years to rebuilt confidence in the PLA´s capabilities. A large military move won´t happen in the near future as it isn´t even possible without the support of the rocket force. Considering the massive purge across the political and military leadership, I think this is the more likely scenario.

So what are the implications?

The ascent of China has slowed down significantly and over the secular horizon. The country is exposed to a number of imbalances and weaknesses, including a shrinking population, low and falling consumer confidence, dysfunctional and dirigiste capital markets, and a real estate bubble which is a threat to the banking sector.

China´s role as low-cost manufacturing hub diminishes, which isn´t good news for finished goods prices, and which adds to the structural forces for higher inflation. Other countries however might very well benefit from the adjustment: Vietnam as the new lowest-cost producer, and Mexico from U.S. near-shoring.

The weapons scandal may ring in a period of political instability in China. Adding in the economic weakness, it´s not clear if president Xi Jinping survives politically.

The probability of a key risk event, a China strike on Taiwan, is much reduced. This is good news for equity markets.

Implications for benchmark bonds are on balance a negative. Apart from the impact of inflation expectations on bond yields, there´s much less need for long-duration government bonds as a tail risk hedge.

The China military situation is highly fluid. The shocking news about the bad state of the rocket forces can´t really be verified externally. However economically, it appears that China is past its peak influence, and has a very difficult adjustment period ahead of it.

As always, let me know what you think.

all the best,

John

The Chinese population is now shrinking, with record low birth rates. In response, the one-child policy was changed into a two-child policy in 2016, and a three-child policy in May 2021.

Forbes, Milton Ezrati, 2023/04/03, Not Everyone, But Many Firms Are Preparing To Leave China

many thanks!