HOW TO LOSE 10 BILLION EUROS: THE MAN BEHIND EUROPE´S REAL ESTATE CRISIS

First, He Dropped out from School, now He Dropped from the Forbes List of Billionaires

René Benko´s Signa Group was Europe´s most flamboyant and self-confident real estate developer. It owns half of the Chrysler Building, one of New York City´s most iconic towers. Signa owned half of Selfridges, the British luxury shopping temple; it owns the Golden Quarter in Vienna, prime property near St. Stephen´s Cathedral and the Imperial Palace of the Habsburgs. Greek shipowners, German car magnates, and the founder of Europe´s largest strategy consulting firm became his investors and allies. But the investment performance of Signa turned out to be too good to be true.

On October 4-6, Munich hosted the annual flagship event of Europe´s real estate industry. Expo Real was everything you would expect of a large trade fair: flashy company booths, sparkling water and finger food, keynote speeches, upbeat salespeople making happy faces. One of the largest booths belonged to Signa, the company of a 46-year-old cunning dealmaker who had made it all the way to the Forbes List of billionaires.

But the discrepancy between the cheerful images which soon flooded social media and the gloomy mood at the meeting couldn´t have been more drastic. “Survive to ´25” became the unofficial motto of the meeting. After a huge rise in financing and building costs, real estate development had come to a virtual stand-still in many countries. “If you don´t have large reserves, and reasonable financing structures, you´re not gonna make it”, a representative of a family office told me.

Signa Group wasn´t anything like that. It ran aggressive property valuations and didn´t have cash reserves. And the source of its fabled investment returns is becoming ever more dubious.

FOUNDATIONS

René Beno had his mind all on making money already in his teenage years in Austria. He spent so much time at multi-level marketing firm AWD (today known as Swiss Life Select), a financial products pusher, and so little time in classroom that he wasn´t going to receive a diploma from his school. Benko didn´t bother any longer and dropped out. In 1995, at age 18, he bought an empty attic in Vienna, Austria´s capital, refurbished it as an apartment, and sold it at a respectable profit. Benko caught that wave early. Attics in residential buildings were an attractive target for rebuilding – essentially there was no need for any new construction to build new apartments, even in sought-after neighborhoods. As refurbishments of attics took off in the 1990s, Benko ran a few more projects.

In an audacious move in 1997, he bought an option for a stake in wellness hotel Lanserhof, which today is known as one of the world´s leading medical spas. Benko found a sponsor, Karl Kovarik, the owner of a car trading company, and together they launched several medical centers across Austria. In 2001 they set up a holding company for their investments, Immofina.

Projects became larger. Benko developed a focus on prime real estate in city centers, and in 2004 launched a bid for the Kaufhaus Tyrol in Innsbruck, a large department store which he rebuilt with British star architect Sir David Chipperfield.

That milestone project under the belt, Benko became ever more confident. In 2007, he acquired a portfolio of 16 inner city buildings from bank BAWAG which had just gone bust on speculations in financial derivatives, and the former headquarters of Bank Austria (today hotel Park Hyatt). He remodeled them into a luxury shopping quarter over the next several years, known as Golden Quarter.

(Golden Quarter, Vienna)

In parallel to the holding company for his own investments, in 2004 Benko set up his first fund for external investors, a closed property fund for large investors like insurance companies.

FULL POTENTIAL

Benko realized that to scale up his business internationally, he needed two more ingredients: access to real money, and street credibility.

Access to money came through George Economou, a billionaire Greek shipowner, whom he met at an event of German Bank HSH Nordbank in Hamburg. Economou bought half of Benko´s holding company which was renamed into Signa Holding.

Credibility and connections came with heavyweights of German industry: Wendelin Wiedeking and Roland Berger. Wiedeking joined Signa in 2011. He had turned around car company Porsche in the 1990s, when Porsche was close to faltering and couldn´t even pay a competitive CEO salary. Berger had founded a consulting firm under his name and made it the main competitor in Europe to the large American firms McKinsey, Boston Consulting, and Bain. Wiedeking and Berger joined the Signa´s board of directors.

With that setup, Signa reached its full potential. Backed by Economou´s money, Benko developed one landmark project after another: Villa Eden, a huge residence on the shores of Lake Garda in northern Italy with 5-star amenities; luxury shopping mall Oberpollinger in Munich, Germany; skiing lodge Chalet N in Lech, Austria, one of Europe´s most expensive skiing areas; to name just a few.

(Chalet N, Lech, Austria)

Typically, Benko set up special purpose vehicles to hold his investments, which started growing into a bigger web of holdings, sub-holdings, and funds.

The visibility and investment returns of Signa´s projects pulled in more investors and new money. In 2012 Benko set up a joint venture with diamond trader Benny Steinmetz to acquire prime location buildings of Karstadt, a chain of department stores, for €1.1 billion. Karstadt was struggling and hoped to use sales proceeds to prop up the remaining business, but eventually in 2014 sold out the rest of the company to Signa as well. Signa´s move was viewed with a lot of skepticism in Germany. Karstadt had long suffered from a decline in sales, and previous investors had not been able to turn it around. Why would Signa be more successful? Benko didn´t have any proven competencies in retail sales or as a turnaround manager.

Benko however had a different strategy in mind. He wanted to take over competing chain Kaufhof as well and merge the two. Kaufhof wasn´t doing much better than Karstadt in an environment for retail selling which had structurally changed and disadvantaged the old department stores. Both chains had historically grown in city centers all over Germany and owned very valuable property, often next to each other. The chains were essentially prime property hand-cuffed to a loss-making business. Merging the companies under a single roof was going to unlock a lot of real estate in the most sought-after locations.

But something was odd. Signa made several offers to Kaufhof owner Metro but wasn´t able to demonstrate it had the liquidity to actually pay for the chain. In a first attempt, Signa suggested to take a loan from Metro. Later, Signa presented vague bank letters. In a third attempt, Signa boasted that its holding company Signa Prime had raised capital to 4 billion euros, which should allow it to buy Kaufhof. But again, it turned out that the raise was mainly due to an in-kind transfer of another Signa entity, which didn´t do anything to improve liquidity. Where was all that money that Signa supposedly made?

Metro eventually sold Kaufhof to Canada´s Hudson Bay Company. HBC struggled for three years to turn around Kaufhof. When its CEO left in late 2017, Signa again sent an offer. In July 2018 HBC agreed, and Signa took over Kaufhof. Signa merged Karstadt and Kaufhof to form Galeria Karstadt Kaufhof, Europe´s second largest chain of department stores after Spanish chain El Corte Inglés. Signa added new layers of holding companies for its acquisitions to its already complex company grid which at this point consisted of about 1,000 companies. Total assets of Signa now amounted to about €12 billion.

But business of the combined entities kept floundering for years. In 2022 alone, the shopping chain experienced losses of several hundred million euros.

WHERE IS ALL THE MONEY?

I´ve followed Benko´s Lake Garda project in Italy´s Lombardy because I found it quite outrageous. Villa Eden was built as a luxury residence in the hills on the west of Lake Garda, a popular travel destination especially for outdoor enthusiasts and families. Villa Eden is a posh residence with infinity pools overlooking the lake, gourmet restaurants and 5-star amenities. But there was one problem: units never sold. Villa Eden stayed largely empty. Signa eventually refurbished the whole place into a luxury resort, but even then it never gained traction with visitors.

But it pales in comparison with Signa´s Chalet N in the Austrian alps. Named after Benko´s wife Nathalie, the lodge is listed as a flagship property on Signa´s webpages (even though formally it belongs to Benko´s family trust Laura). It houses up to 18 guests, has an indoor pool, a movie theater, a wine cellar, a permanent kitchen team, a butler, and two black Range Rovers at the disposal of guests. The off-season rental rate is €30,000 – per day. Rates exceed €40,000 in the peak season, or around €300,000 per week. The lodge is mostly empty, except at times when Benko and his family or friends stay there.

While a number of properties, including Galeria, didn´t look like they generated meaningful cash flow, Benko´s two largest operating holdings, Signa Prime and Signa Development, authorized about €1 billion of dividend payments to owners between 2016 and 2021 (dividends were suspended in 2022, due to liquidity constraints). Even if Villa Eden and Chalet N are not representative for the financial performance, where did the money come from? Did it come at all? French billionaire family Peugeot (yes, the car dynasty) owns 4.6% of Signa Prime but has said it never received the 2021 dividend. Mysteriously, Benko´s older buddies, George Economou and Wendelin Wiedeking had long left.

GET RICH QUICK

Investment returns in real estate come from two sources, income and appraisal value gains. In a Bloomberg analysis based on data from Signa Prime, the key holding for Benko´s investments, appraisal gains dominated Signa´s investment performance. In 2019, value gains contributed around a billion euros, vs. an EBITDA1 of just above €200 million euros. In 2020, value gains were €750 million, EBITDA around €200m; in 2021, another billion in value gains vs. EBITDA of €200m.

The appraisal value of a building is usually derived as a multiple of rental income. So how do you push up the value? Raise rents. For example, Benko increased the rent of Karstadt Sports in Hamburg, a building which he had bought for €55 million in the first Karstadt deal. Simultaneously he injected cash to enable Karstadt Sports to pay the lease. Based on increased rental income, Benko sold the property for €100 million, and replicated that trade in six additional transactions in 2013 alone.

Another suitable occasion to write up (or down) the valuation of a building is at a sell. Benko developed a blueprint for that maneuver already at his breakthrough project, the Kaufhaus Tyrol in his hometown Innsbruck. The department store was owned by Signa Fonds, the investment vehicle for external investors, via holding companies (I guess you see the pattern by now) and had a book value of €152 million. The fund sold the property to an entity outside the Signa Group called Globalbasis Ltd (owned by Benko´s buddy George Economou), which in turn passed it on immediately (on the same day) to Benko´s Signa Prime Holding – where it was promptly appraised at €229 million. I would be very curious to hear how the investors in Signa Fonds think about that transaction.

Nice as all those gains in value are, there´s also a problem. They do not generate any cash. Without cash, there are no dividends. This is where Signa Real Estate Management (REM) enters the frame.

Signa REM is an internal served provider which advises other Signa companies on buys, sells, and rentals. For those services REM charges a fee: €20 million in 2014; €50 million in 2017. Remember the capital raise to finance the purchase of Kaufhof? The company which was added to Signa Prime as an in-kind-transfer was none other than Signa REM, which was used to route liquidity through the Signa system to Signa Prime. Other service providers added to the scheme. When around 50% of the group of premium shopping centers of Karstadt was sold to Italian group Rinascente in 2015, a Signa service company earned €10 million as a fee. In 2013, Signa Prime distributed a dividend of €30 million on rental earnings of only €13 million. The balance was covered by income from management fees of €38 million. Fees for which service? That remains unclear.

BLOW-UP

The economic environment took a turn in 2021 with a devastating impact on Signa. In the context of supply chains disruptions due to Covid and amplified by the explosion of energy prices after Russia´s invasion in Ukraine, construction prices skyrocketed.

For a notoriously cash-strapped company like Signa this was the worst-case scenario. In early 2023, the first red flags on the company´s health popped up.

In spring 2023, Signa had agreed to support its large shopping chain Galeria with a loan of €200 million. By summer, the money still had not arrived, putting Galeria on the trajectory of a potential failure.

In early October 2023, Benko declined an urgent request of another retail subsidiary, Signa Sports United, for a cash loan of €150 million. Signa Sports went into bankruptcy.

At the end of October, finally the magenta alarm went off on Signa. The construction company building Signa´s Elbtower announced it had not received due payments from Signa. The Elbtower is a €1 billion development on Hamburg´s waterways and one of Germany´s highest office towers.

(Model of Elbtower, Hamburg)

In November 2023, Signa Holding, the top-level entity in the Signa cluster of companies, filed for bankruptcy. Signa REM filed as well. Both are seeking court approval to continue operations under a restructuring plan in analogy to a U.S. chapter-11 filing. Signa Prime, the largest entity with total assets above €20 billion is working on a filing. Signa Prime is majority-owned by Signa Holding with minority stakes of private investors like the Peugeot family.

Construction projects across the group are halted. All of a sudden, several of Germany´s leading cities including Hamburg, Munich, and Stuttgart, are facing huge construction sites on prime locations which are unfinished with an uncertain future.

(deserted construction site Alte Akademie, Munich)

ENDGAME

The real estate industry in Germany is in a state of shock. Signa has to come up with around €2 billion for debt repayment in the next 6 months, of which €200 million were due until the end of November. As talks with potential investors seem to have failed to provide emergency funding, we´ll have to assume Signa defaulted on repayment.

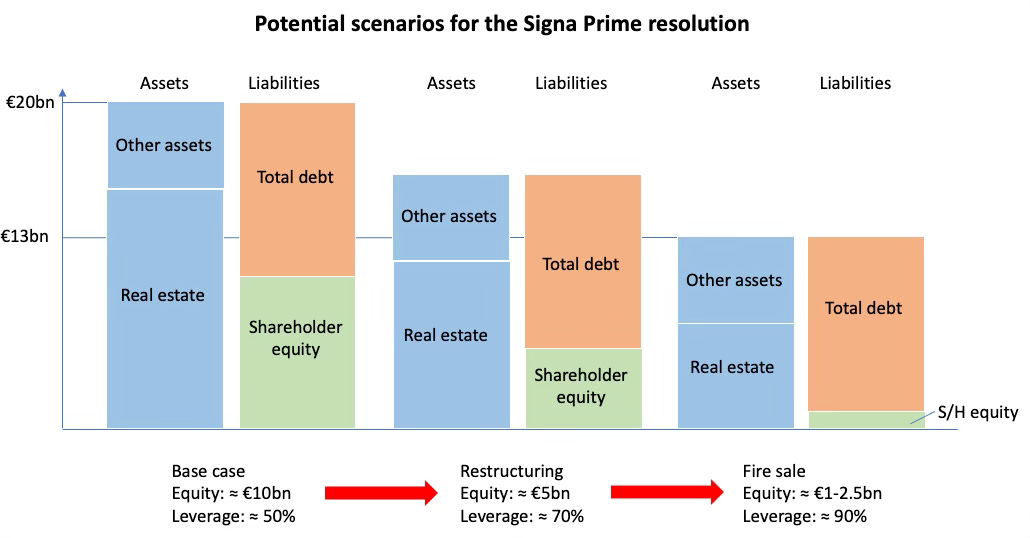

Signa Prime is now at the center of attention. Signa Prime holds key properties of the group with total assets of more than €20 billion at the end of 2022. Now it is in restructuring mode under new management. It needs to raise a lot of new money, quickly. The owners are facing difficult choices: throw in good money after bad one, of at least €2 billion, and try to keep the company alive; or raise the money with a fire-sale of assets.

A fire-sale will be the “nuclear option”. According to the Financial Times, Signa sold its 50% stake in one of the top Karstadt properties, Berlin´s famous KaDeWe, at a discount of 60% to book value in spring (the other 50% are held by Italian group Rinascente). Properties like Villa Eden in Italy, whose units never sold and which never gained traction as a holiday resort, will likely fetch even less. The market appetite for large transactions is particularly low at the moment. According to real estate analysts at Avison Young, total transaction value in Germany amounted to just €3.5 billion in the first nine months of 2023, a tiny fraction of the long-term average.

Signa´s Upper West tower in Berlin has a book value of over €700 million, and a mortgage on it of €300 million. If the sale of KaDeWe (proceeds of €300m on a book value of €750m) is any guidance, the property is essentially worthless for owners if sold now.

The way I see it, under current market conditions and considering the huge markup in Signa´s books, the average discount might be 50% in an optimistic scenario, and as large as 60% in a bad scenario. Signa is not very transparent about its financial statements, but in a back-of-the-envelope calculation I would estimate that overall, in a fire sale, the net asset value might be as low as €1-3 billion. Throw in a valuation discount on other assets, and it might be zero as well.

Alternatively, to keep Signa Prime going, the owners will have to drum up €2 billion in the next few weeks. Some of them probably have the financial muscle, like German billionaire Klaus-Michael Kühne, the Peugeot family, or Swiss investor Longbow Finance. However others like RAG, a public trust which finances the German exit from coal energy, and Union Investment, a German mutual fund manager, probably have much less appetite.

In the recapitalization scenario, assessors will run the whole property portfolio through a revaluation process to determine asset values starting from a clean sheet of paper. They will use market-standard rentals and current earnings multiples. I´d be surprised if the mark-down from current book values were less than 30%.

What about René Benko himself? A year ago he was on the Forbes List of billionaires with a net wealth of $6 billion. He´s no longer on the list.

Benko indirectly owns about 40% of Signa Prime and will have to participate in the recapitalization to keep a stake. Rumors circulate he is busy liquidating private assets, including paintings by Picasso (“L’Étreinte”), Jean-Michel Basquiat, and Andy Warhol; and his 62-meter yacht Roma. But Benko has another huge headache on top of chipping in his share to recapitalize Signa Prime: reportedly he posted both his private residence in Innsbruck and a 50% stake in Chalet N, his family skiing retreat, as collateral for loans to Signa.

Signa Prime is expected to present a bankruptcy restructuring plan to courts before Christmas. Who knows, it may be the last time René Benko spends the holidays in his posh resort at the Arlberg.

Hope you liked that posting! I think you´re well aware a lot of research and number-crunching goes into such a writeup. Please support my work and subscribe. It would mean the world to me. Many thanks!

DISCLAIMER

It is very difficult to obtain financial data on Signa entities. Signa does not produce timely financial statements for key entities like Signa Holding, and does not produce consolidated financial statements for the company group. Data provided in these pages are obtained from sources believed to be reliable, but not guaranteed. I report these data on a good-faith basis. My scenarios for the resolution of Signa are projections based on a limited data set. I believe the scenarios are plausible, but of course I can be very wrong. I provide the scenarios as input for discussion.

EBITDA: earnings before interest expense, taxes, depreciation, and amortization. The metric is supposed to be a proxy for operating cash flow. Or in the interpretation of Charlie Munger of Berkshire Hathaway: “bullshit”.