Destabilized

The next financial crisis? Watch out for Stablecoins.

Dear readers,

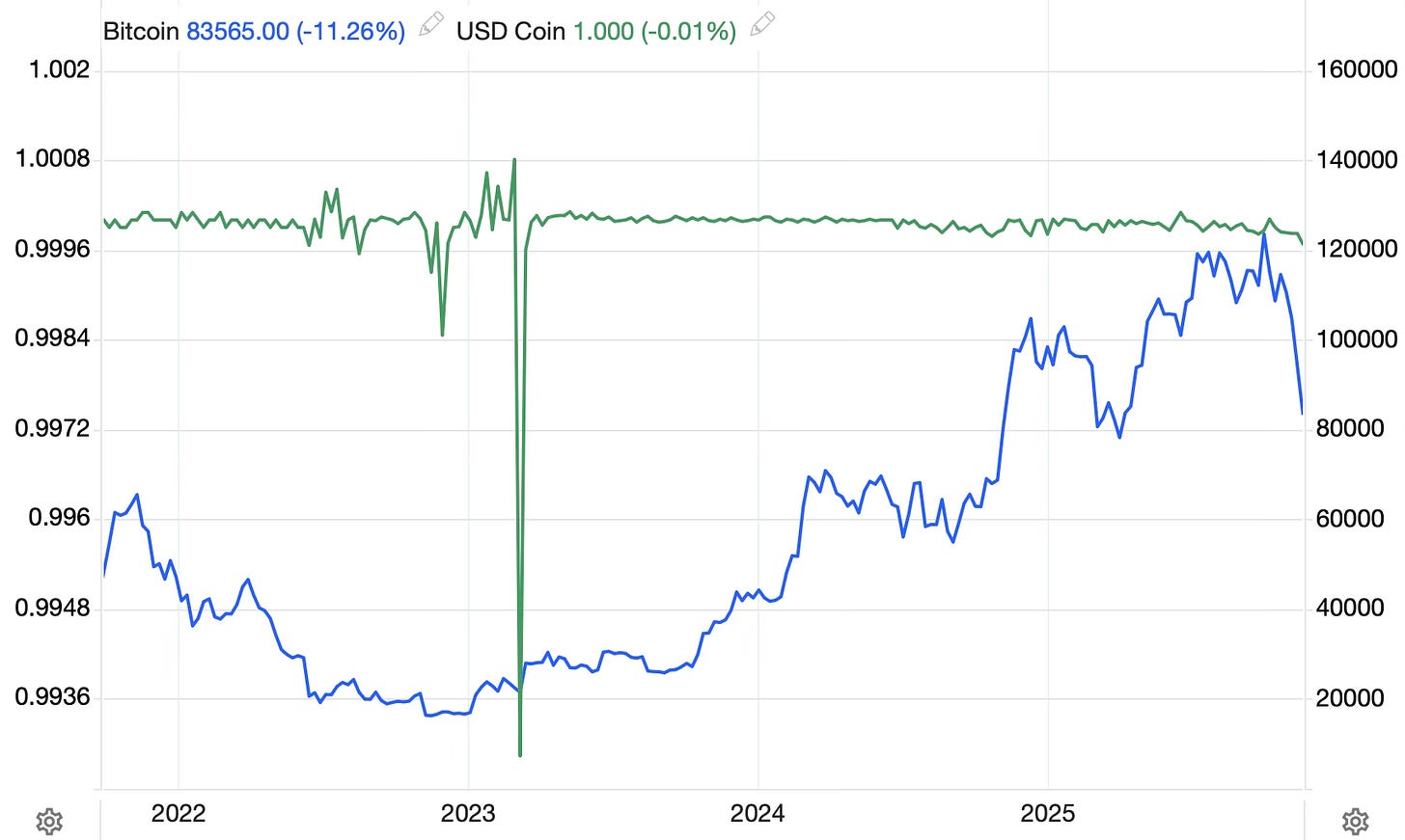

The cryptocurrency world is transitioning into developed finance quickly. Public attention is still largely focused on ur-token Bitcoin, the original cryptocurrency best known for its enormous volatility - unit values reached almost $125,000 in early October, but are dropping towards $80,000. The real deal however is stablecoins, cryptocurrencies which are pegged to the dollar at a fixed exchange rate. Make no mistake, trade in tokenized assets will revolutionize finance. Safety procedures have been improved, operational complications have been resolved. Pegs to real-world assets take out volatility. Global transactions based on cryptocurrencies are easier, faster, and more secure than dollar-based transactions. Paradoxically, all this is setting up a dangerous imbalance. The transitional phase might well lead into the next global financial crisis – the first harbingers have already arrived.

Hope this is an interesting read for you!

On July 18, 2025, U.S. President Donald Trump signed the GENIUS act (Guiding and Establishing National Innovation for U.S. Stablecoins) on digital currencies. The act addressed stablecoins, a special class of cryptocurrencies which maintain a fixed exchange rate to the U.S. dollar. The act obliges issuers of stablecoins to build reserves which fully back coins with dollars or save assets such as treasury bills to make sure the exchange rate remained fixed. Effectively, the GENIUS act turned stablecoin issuers into mini central banks in full reserve banking systems.

(Crypto volatility, Bitcoins vs. USDC/ USD Coins. Bitcoins depreciated from around USD 125,000 to just above $83,000 since early October. In contrast, stablecoins such as USDC are pegged to the dollar, usually at an exchange rate of $1, with very little fluctuation around the peg - except for a brief dip in March 2023. That dip, as it turns out, is very revealing.)

The GENIUS act in the U.S. and MiCA in the EU (Markets in Crypto Assets Act) are parts of an ongoing effort to make crypto assets more investable and more widely used.

On January 10, the SEC in the U.S. approved Bitcoin ETFs. The approval was a milestone for BTC investments. Before the launch of ETFs, investors had to open wallets on digital exchanges or with off-exchange providers, basically a wild-west world which exposed investors to large fraud and operational risks in the past. ETFs removed this layer of complexity and uncertainty. At the time of the approval, BTC traded at $42,000. It climbed to $125,000 by the end of September 2025.

The GENIUS act addressed to stability and convertibility of stablecoins, removing another layer of risk and providing a government seal of approval.

Stablecoins offer many benefits for users. They can send and receive payments for purchases around the clock. No waiting for bank business hours or 2-day settlement cycles – crypto transactions are recorded and settled on blockchains, outside the traditional banking system. For international trade, companies traditionally had to rely on networks of correspondence banks to route payments through local banks and through payment systems like SWIFT. Cryptocurrencies remove those layers of complexity and complications – payments are sent from one wallet to another, regardless of the physical location, with almost immediate confirmation1.

Keep reading with a 7-day free trial

Subscribe to The Econolog to keep reading this post and get 7 days of free access to the full post archives.